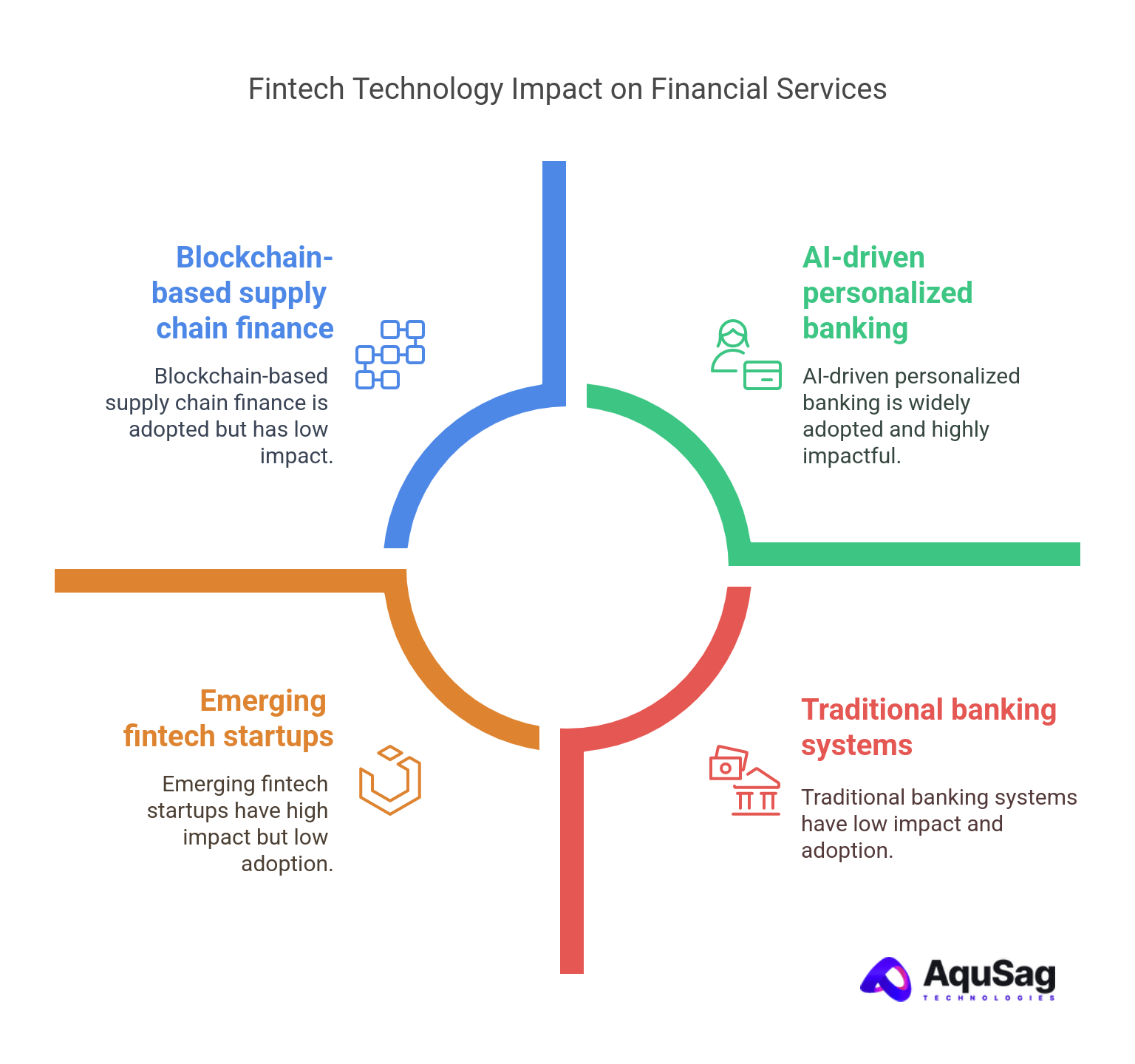

The financial services industry is undergoing a profound transformation. Traditional banking systems, once defined by paperwork, physical infrastructure, and human intermediaries, are being rapidly replaced—or at least supplemented—by digital-first, intelligent solutions. At the heart of this evolution lies financial technology (fintech), a sector that's not only disrupting conventional financial models but also unlocking new growth opportunities across healthcare, software, logistics, eClinical, manufacturing, and enterprise tech industries.

Among the most transformative technologies driving this shift are Artificial Intelligence (AI) and Blockchain. Together, these technologies are laying the groundwork for a decentralized, transparent, and hyper-personalized financial ecosystem.

In this blog, we’ll explore how AI and Blockchain are shaping the future of financial services, the implications for cross-industry innovators, and why now is the time to engage dedicated technology partners like AquSag Technologies to stay ahead of the curve.

Fintech in 2024: A Snapshot

As of early 2024, the global fintech market is projected to reach $556.58 billion by 2030, growing at a CAGR of 19.5% from 2023 to 2030 (Source: Market Research Future). Investment in fintech startups surged in the second half of 2023, especially in segments like decentralized finance (DeFi), embedded banking, and robo-advisors.

Simultaneously, sectors such as healthcare, logistics, and manufacturing are increasingly integrating fintech solutions—such as digital wallets, invoice financing, and supply chain lending—to streamline operations and improve customer experiences.

Featured Blog Post: Powering the Future: Digital Solutions for a Sustainable Energy Grid

Artificial Intelligence: The Brain of Modern Fintech

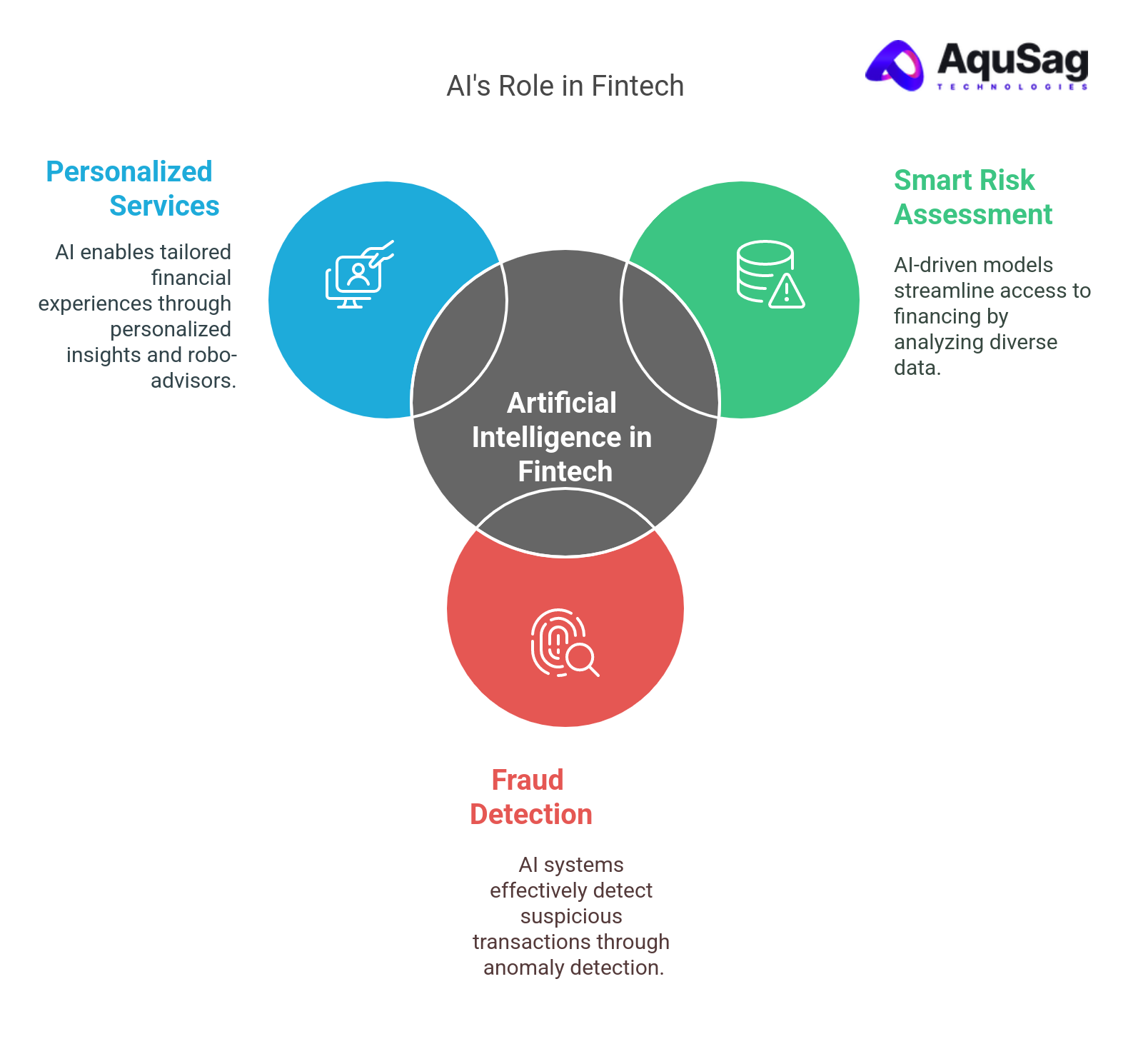

AI is reshaping every layer of the financial stack, from front-end customer engagement to back-end risk analysis and fraud detection. With advancements in machine learning, natural language processing (NLP), and predictive analytics, financial institutions are now able to process massive volumes of data to derive insights, personalize offerings, and automate decision-making.

Smart Risk Assessment and Underwriting

For industries like logistics or manufacturing where capital-intensive operations are common, AI-enabled credit scoring and risk assessment models are streamlining access to financing. Instead of relying solely on traditional credit reports, lenders now use AI to analyze cash flow, supply chain metrics, and real-time operational data, enabling more inclusive and accurate underwriting.

Fraud Detection and Transaction Monitoring

AI-powered systems are increasingly effective in detecting suspicious transactions. Using anomaly detection and behavioral analysis, these systems learn what constitutes a normal transaction for each user, making it easier to flag unusual activity. According to a 2023 McKinsey report, AI can reduce fraud detection false positives by up to 50%, significantly improving operational efficiency.

Personalized Financial Services

In software and healthcare sectors where personalization is crucial, AI is enabling hyper-tailored experiences—from budgeting apps that offer customized insights to robo-advisors that dynamically rebalance investment portfolios based on user behavior.

Conversational AI and Chatbots

NLP-driven chatbots and voice assistants have revolutionized customer service. Banks and fintech platforms now offer 24/7 intelligent assistance, with AI interpreting queries, providing answers, and even executing transactions. In B2B environments, this translates to faster response times and improved operational continuity.

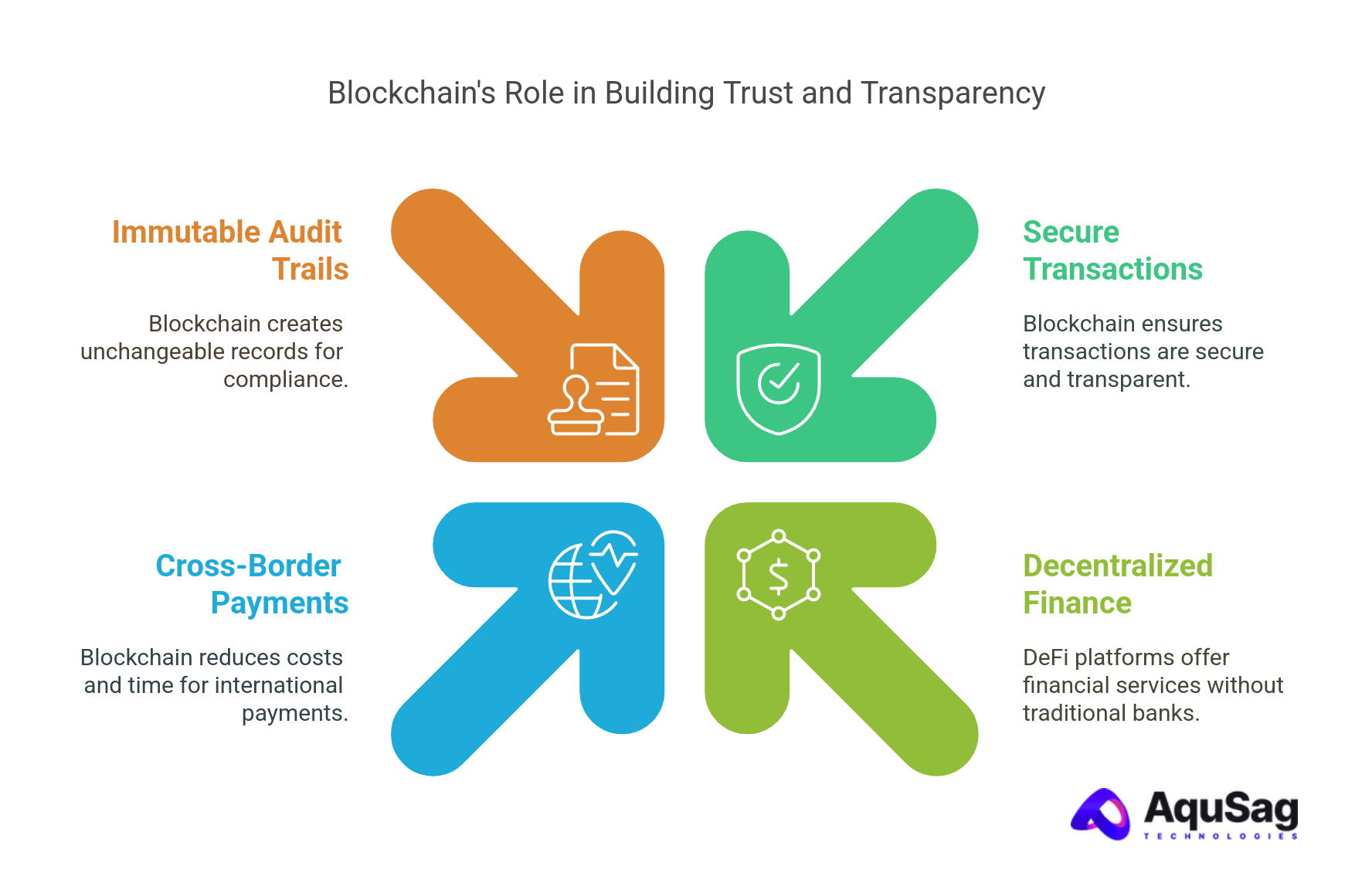

Blockchain: Building the Backbone of Trust

While AI brings intelligence, blockchain brings trust and transparency. This decentralized ledger technology is transforming the way data and value are recorded, transferred, and audited—making it a cornerstone of next-generation financial infrastructure.

Secure and Transparent Transactions

Blockchain eliminates intermediaries, reduces transaction fees, and ensures traceability. For logistics and supply chain companies, blockchain-enabled smart contracts can automate payments upon fulfillment of conditions—minimizing disputes and reducing time to revenue.

Decentralized Finance (DeFi)

DeFi platforms, built on blockchain networks like Ethereum and Solana, enable users to lend, borrow, trade, and earn interest without traditional banks. By mid-2023, DeFi platforms held over $45 billion in total value locked (TVL) (Source: DeFi Pulse). For eClinical and enterprise tech firms, these platforms offer innovative capital-raising mechanisms like tokenized equity and yield farming.

Cross-Border Payments

Blockchain significantly reduces the cost and time of cross-border transactions. In manufacturing and healthcare industries where international payments are routine, blockchain-based solutions provide instant settlement and real-time tracking.

Immutable Audit Trails

For sectors with strict compliance requirements (like healthcare and software), blockchain creates immutable audit trails that enhance data integrity. Smart contracts can be used to enforce SLAs and manage procurement automatically.

Featured Blog Post: The Future of Education: How AI is Transforming Learning

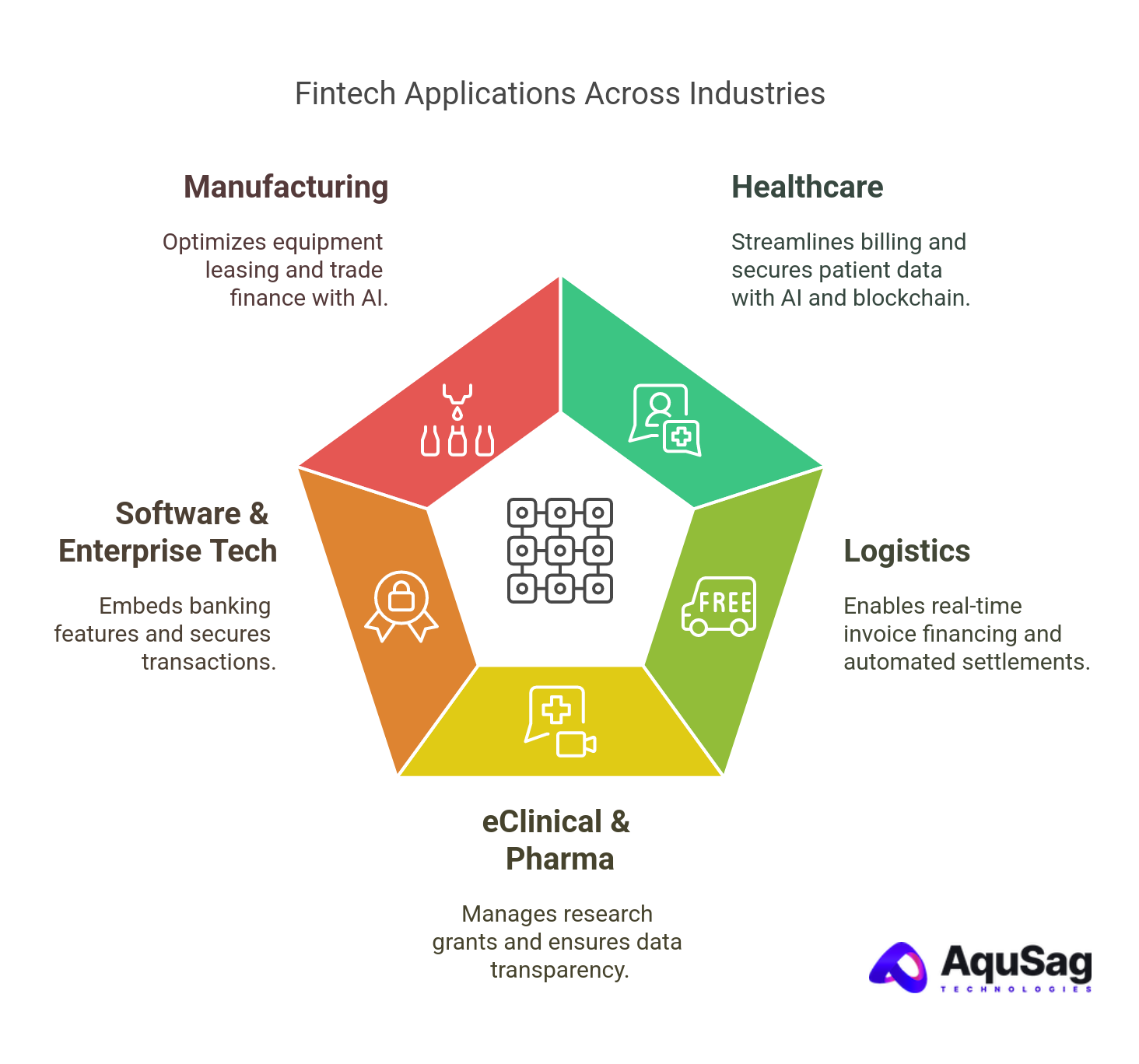

Industry-Specific Fintech Use Cases

Healthcare: Real-Time Billing and Insurance Processing

AI-driven fintech solutions are automating healthcare billing, reducing claim denials, and streamlining patient payments. Blockchain ensures secure sharing of financial and medical records among providers, insurers, and patients.

Logistics: Supply Chain Finance

With blockchain-backed systems, logistics companies are enabling real-time invoice financing and automated settlement upon delivery confirmation. AI enhances fleet financing by analyzing vehicle usage, maintenance data, and contract terms.

eClinical & Pharma: Grant Disbursement and Compliance

Pharma companies and research institutions use blockchain to manage research grants, ensuring transparent disbursement and verifiable data. AI supports budgeting, resource allocation, and predictive modeling for trial costs.

Software & Enterprise Tech: Embedded Finance

Software vendors are embedding banking features into their platforms—offering payments, lending, and insurance directly to users. AI helps optimize product monetization, while blockchain secures transactions and prevents chargebacks.

Manufacturing: Equipment Leasing and Trade Finance

AI assesses machine utilization and predictive maintenance data to streamline leasing decisions. Blockchain ensures that financing terms are fulfilled through smart contracts, reducing paperwork and delays.

Challenges and Considerations

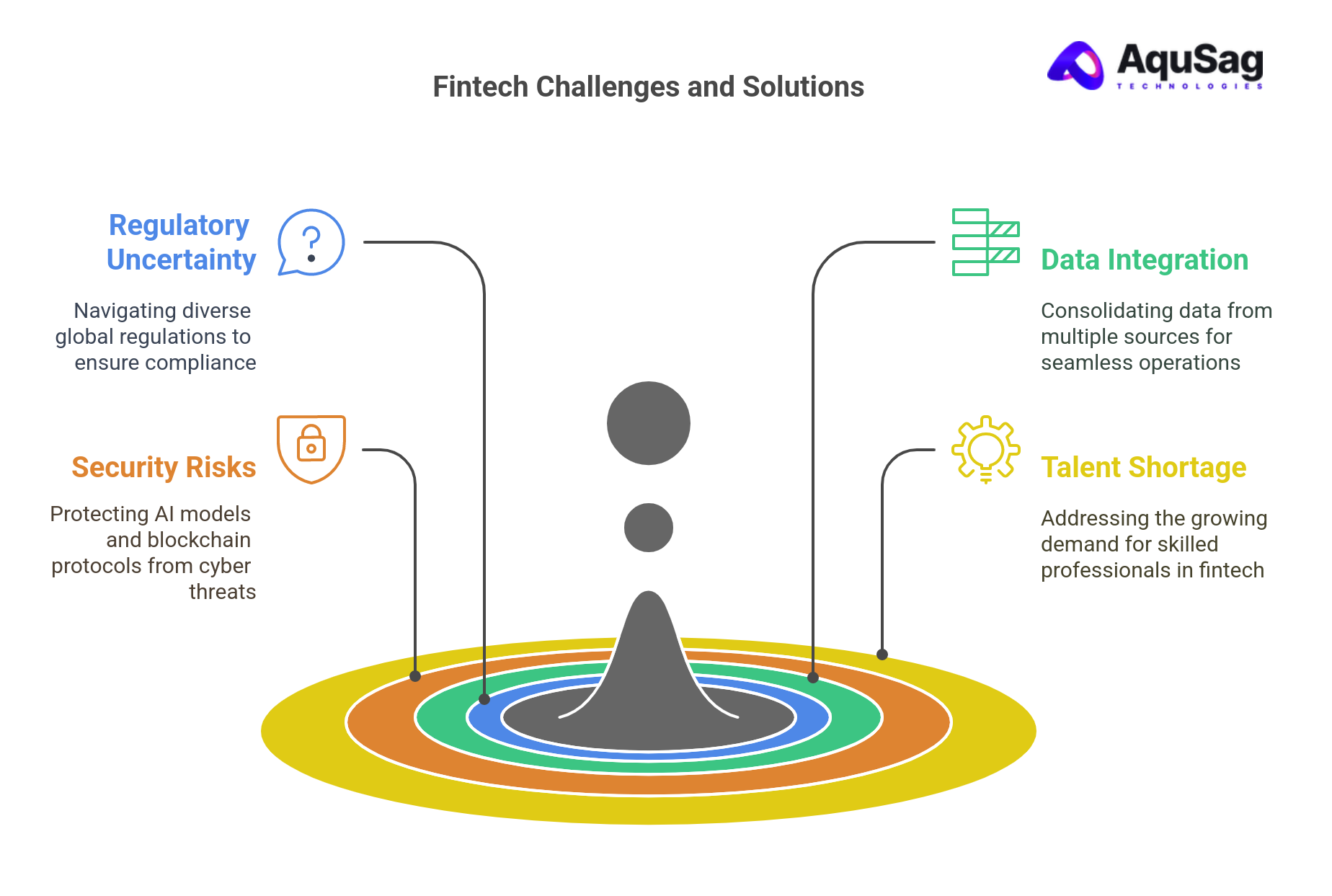

While the promise of AI and blockchain in fintech is compelling, businesses must navigate several challenges:

- Regulatory Uncertainty: Varying global regulations around data privacy, AI ethics, and crypto assets can delay adoption.

- Data Integration: Consolidating structured and unstructured data from multiple sources remains a hurdle.

- Security Risks: Both AI models and blockchain protocols are susceptible to sophisticated cyber threats if not properly managed.

- Talent Shortage: There is a growing demand for AI engineers, blockchain developers, and fintech consultants.

These challenges reinforce the need for expert guidance, experienced development teams, and agile digital transformation partners.

The Role of Dedicated Technology Partners

For companies in healthcare, software, logistics, AI/ML, and other sectors, leveraging fintech innovation isn’t just about deploying new tools—it’s about orchestrating a holistic digital transformation. This is where AquSag Technologies comes in.

As a trusted partner in full-stack development, blockchain consulting, AI/ML integration, and team augmentation, AquSag helps forward-looking organizations:

- Build scalable fintech platforms from scratch

- Integrate AI into existing financial workflows

- Implement secure, enterprise-grade blockchain solutions

- Rapidly scale with vetted developers and domain specialists

Our teams work closely with CTOs, product leaders, and innovation heads to align technology with business strategy, regulatory requirements, and market needs.

Conclusion: Shaping the Future, Today

AI and blockchain are not just buzzwords—they are the foundational technologies shaping the future of finance. Their impact goes far beyond banking, unlocking new efficiencies, transparency, and value across industries like healthcare, logistics, eClinical, and enterprise tech.

As fintech becomes increasingly embedded into everyday operations, companies that fail to adapt risk falling behind. Whether you're looking to launch a new product, modernize an existing platform, or explore cutting-edge financial innovations, now is the time to act.

Partner with AquSag Technologies to tap into the transformative power of AI and blockchain. Let’s build the future of finance—together.

Contact us today to schedule a free consultation or discuss your fintech development roadmap